Research + Strategy

USAA Junior Enlisted Membership

Applying an evidence-based approach to solving a mission critical business and customer problem.

Role: I led research, synthesis, and stakeholder coordination. I facilitated research interviews with two other designers and collaborated with multiple cross-functional teams.

Opportunity

USAA’s core mission is serving the military. Their active duty membership declined by over 40% since 2010 and no one knew why.

I was assigned to this project to help evaluate our workstreams and bring alignment to how we reverse the decline. I worked with our analytics team to identify that 80% of the decline was attributed to E1-E4 enlisted personnel in specific branches and regions. There was urgency, which caused teams to react without purpose and created these additional business problems:

There was no aligned model for the current or ideal state of the experience for enlisted personnel.

We lacked a strong, data-driven perspective about their motivational and behavioral drivers.

We didn’t know if our approach was relevant to their needs.

We risked not having clear, aligned criteria for prioritization and a strong baseline to measure our impact.

Alignment

The business was fixated on awareness and acquisition, but analysis exposed major cracks in our servicing.

Out of 458,123 enlisted members, 202,781 had a membership with us but no active products. I facilitated a two-day workshop with stakeholders across the enterprise to align on scope, business problems, current experience, and unknowns. We aligned on two key themes:

We made it hard to be a member. Our processes were at odds with an accelerated military lifestyle, especially during early enlisting touchpoints.

Our banking products were not for someone early in their financial journey. Our risk tolerance and bank primacy success metrics didn’t set us up to successfully serve this audience.

I was scoped to help build alignment, but we needed a strategy. I worked with stakeholders on scoping a longer engagement to research the needs of enlisted personnel and define new opportunities.

User research

Based on the riskiest unknowns, I developed a research plan and approach.

To increase efficiency, I made a case to assign two additional designers to help facilitate interviews. We conducted 1:1 interviews in North Carolina and Virginia near military bases. I developed co-design activities to adapt to their situation and use as stimuli to elicit their stories. Research goals were focused on understanding the depth of relationship with current bank or insurance provider, the perceived value of membership, military events that lead to financial decisions, and their process for discovering military benefits.

Key findings

We just don’t talk about it

The vulnerability required to discuss financial health contradicts military culture. Leaders are intertwined with the military's resources and opening up about their struggles is a barrier to accessing them.

Trust no one above your buddy

They rely on peers to navigate the military’s steep learning curve as they become overwhelmed by the information they receive through lectures, newsletters, paperwork, and briefings.

Member means customer

The eligibility process creates an impression that USAA membership comes with benefits tailored to military life experiences. They feel let down when realizing membership means nothing more than being a customer.

No one is looking out for me

They are in a state of financial scarcity due to low salaries and issues in pay distribution. They don’t have the time or experience to identify a dangerous financial situation, especially when the military bureaucracy is at fault.

Meet me where I am

Recruits feel it’s a right of passage to open an account with (NFCU) Navy Federal. There was no perceived difference between USAA and NFCU other than location accessibility. There were 17 NFCU physical branches within 10 miles of Norfolk, VA and one closed USAA branch.

"Preparing for deployment… You're on your own. Here's the checklist. Get it done. You’re pushed through this pipeline and know nothing.”

— E2 non-member

“I was supposed to get reimbursed from the day I got married. It's been two months and no money. I'm not able to make my half of rent payments.”

— E1 member

Outcome

I embedded on design teams across the company and helped move three workstreams forward.

My role was process mapping, exploring high-fidelity ideas, and stakeholder coordination. Teams were responsible for execution and delivery. I also did an audit of our military-specific offerings. Ones that mapped to a need weren’t differentiated or were duplicative of what the military offered. This activity gave us a clearer picture of where to focus and how to expand existing products.

Due to compliance constraints, releasing new banking products wasn't feasible so we focused on partnership and servicing opportunities on military bases, reimagined how we present advice around military life events, and expanded insurance product features.

If you are interested in learning more about this work, reach out, and let’s chat.

-

Military verification

A barrier to acquiring products was replaced with a digital upload tool. The burden on service representatives was reduced and new member accounts stopped closing due to untimely verification.

-

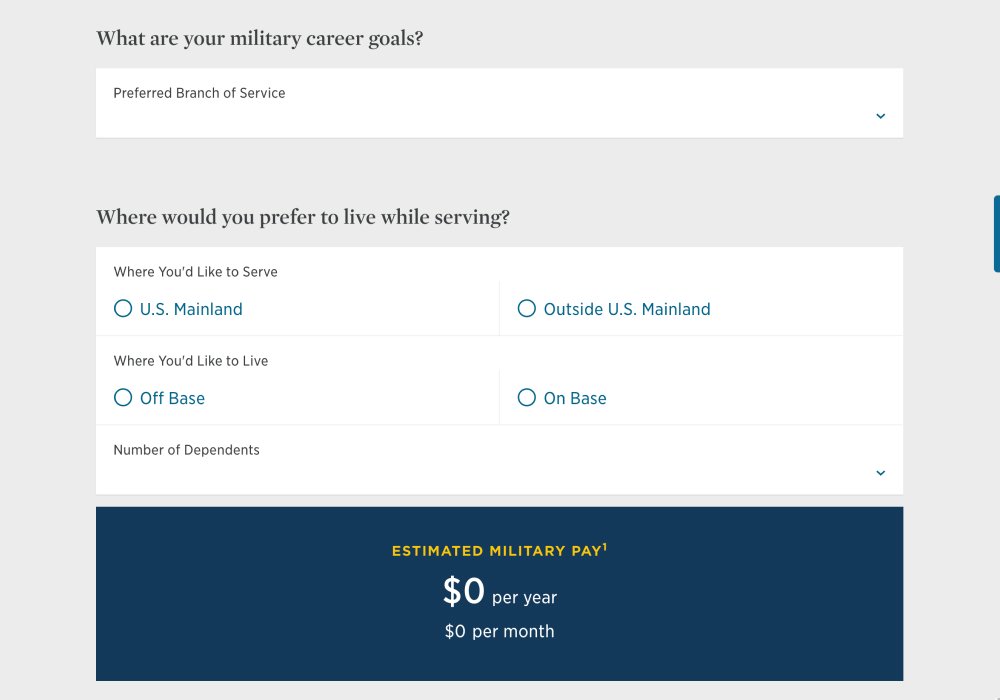

Pay calculator

To become an early touchpoint pre-acquisition, the pay calculator was redesigned to complement the enlisted experience. After the redesign, usage increased by 35%.

-

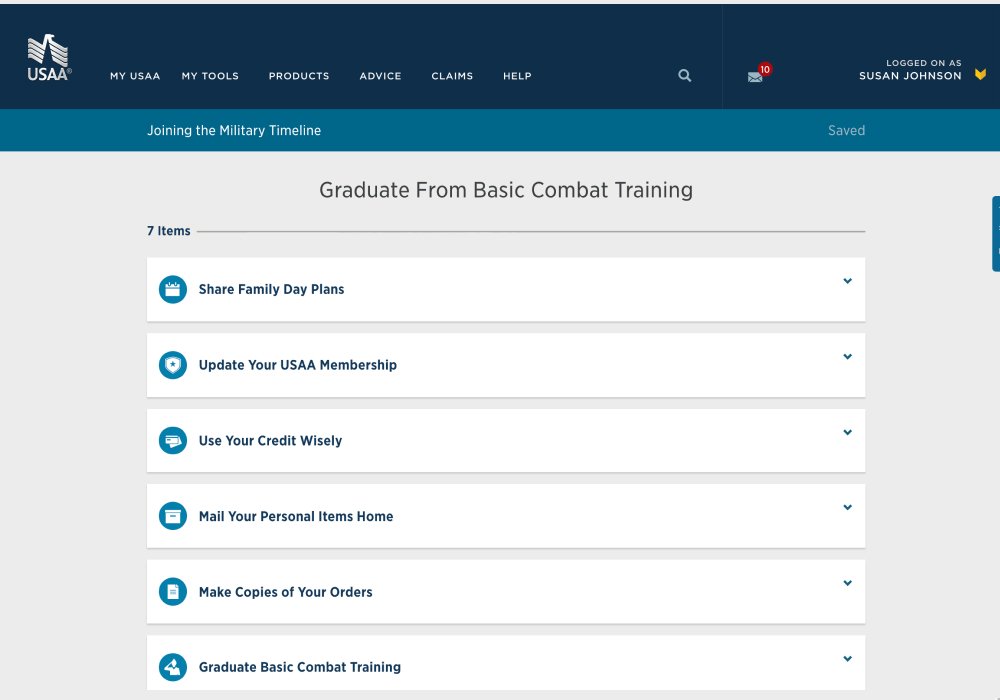

Military timeline

The enlisted timeline was a personalized journey based on branch of service, enlisted date, and base. It was accessible without authentication and it mapped military events to advice and relevant products.

Key results

There was a 28% increase in enlisted membership and 16% increase in active membership.

We reduced risk by extending scope beyond acquisition and building a data-driven perspective.

Projects in the portfolio layer mapped to a validated business and customer problem.